Relying solely on grants to fund your nonprofit is like trying to balance on a one-legged stool. It works—until it doesn’t.

Grants are undeniably valuable, but they come with serious limitations: hyper-competitive applications, rigid usage rules, and the constant threat of funding cuts. For nonprofits seeking financial stability and long-term growth, diversifying revenue streams isn’t just a “nice to have”—it’s essential.

So, how do you go beyond grants to build a more resilient funding model? The answer lies in tapping into private funding sources that offer flexibility, scalability, and, most importantly, control.

Here are 7 proven private funding streams that can help your nonprofit grow beyond its wildest dreams.

1. Individual Donors: Small, Big, and Everyone in Between

Why It Matters: Individual donors contribute nearly 70% of all charitable giving in the U.S. — more than corporations and foundations combined.

Individual donors are the backbone of nonprofit sustainability. Unlike grants, individual contributions aren’t bound by restrictive terms. Even better? When cultivated properly, individual donors tend to give repeatedly, especially when enrolled in monthly giving programs.

How to Tap Into It:

- Storytelling is your superpower: Share compelling stories that spotlight the human impact of your work.

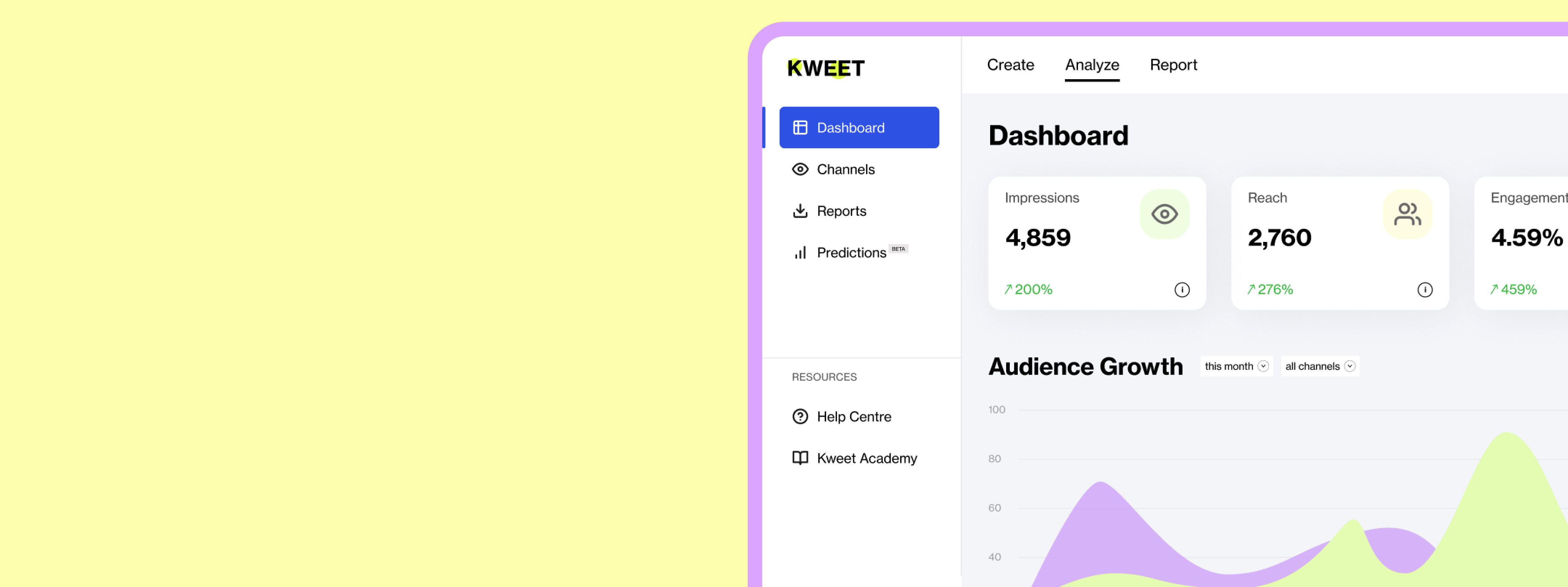

- Use Kweet (👋) to amplify your reach on social media and attract new donors.

- Build a monthly giving program (think “$10/month to change a life”) and promote it consistently.

Quick Win: Create an email campaign with a compelling story of impact, a clear ask, and a call to action for monthly giving.

2. Corporate Partnerships: Pitching “Win-Win” Relationships

Why It Matters: Companies want to align with good causes—and they’ve got the budget to back it up.

Corporate partnerships can look like sponsorships, cause marketing (like those “round up at checkout” campaigns), employee matching gifts, or in-kind donations. Companies benefit from brand visibility, good PR, and employee engagement, while nonprofits get steady financial support.

How to Tap Into It:

- Identify companies with shared values and missions.

- Pitch them a “win-win” proposal: What’s in it for them? Brand exposure? Community goodwill? PR boost?

- Offer multiple partnership options (event sponsorship, employee volunteer days, co-branded campaigns).

Quick Win: List 10 local or mission-aligned businesses and send a friendly outreach email offering a partnership opportunity.

3. Major Gifts: Big Wins from Big Givers

Why It Matters: The right ask from the right person can change your entire funding landscape.

Unlike small, recurring donations, major gifts are significant one-time contributions from high-net-worth individuals. The beauty? Just a few large gifts can have an outsized impact on your nonprofit’s budget.

How to Tap Into It:

- Use prospect research tools like DonorSearch or WealthEngine to identify potential major donors.

- Build relationships before making “the ask.” People give to people, not organizations.

- Offer a transformative vision: “Your gift of $100,000 could build a new shelter for 150 families.”

Quick Win: Identify 3 potential “big fish” donors in your network. Set up a 1:1 meeting to share a big, bold vision for your organization.

4. Peer-to-Peer Fundraising: Let Supporters Fundraise for You

Why It Matters: When your supporters become fundraisers, your reach multiplies exponentially.

Peer-to-peer fundraising allows your existing supporters to raise money on your behalf. Whether it’s for a birthday, marathon, or special cause, it taps into their personal networks, giving you access to fresh donors.

How to Tap Into It:

- Use platforms like Classy, GoFundMe, or Facebook Fundraisers to enable peer-led campaigns.

- Launch a “Friendraiser” campaign and invite your closest supporters to fundraise for you.

- Create an easy-to-follow Fundraising Toolkit to help supporters succeed.

Quick Win: Launch a “Birthday Fundraiser” challenge where supporters pledge to raise funds on their birthday for your cause.

5. Recurring Revenue Models: Predictable, Sustainable Funding

Why It Matters: Monthly giving = steady cash flow.

Imagine knowing exactly how much revenue you’ll get next month. That’s the power of a recurring giving program. It’s like a Netflix subscription but for good causes. Recurring donors are also more loyal and engaged than one-time givers.

How to Tap Into It:

- Launch a branded “Give Monthly, Change Lives” campaign.

- Use social proof (like “Over 200 people give $10/month to support our work”) to encourage others to join.

- Make it easy—1-click setup and simple cancellation options.

Quick Win: Create a landing page for a “Monthly Giving Program” and link it in your email footer, website, and social media bios.

6. Earned Income For Nonprofits: Build Revenue You Control

Why It Matters: Earned income gives you the ultimate control over funding.

Earned income means selling services, products, or access to resources. Unlike grants or donor funding, you own this revenue source completely. Think workshops, certifications, social enterprise initiatives, or selling mission-aligned products.

How to Tap Into It:

- Charge for workshops, events, or educational content.

- Launch a small product line (e.g., a t-shirt, mug, or journal tied to your cause).

- Monetize existing services (like offering consulting or training).

Quick Win: Brainstorm 1 paid offering you can test this month (like an e-book, training, or workshop).

7. Donor-Advised Funds (DAFs): Accessing Wealth Hidden in DAFs

Why It Matters: There’s $234 billion sitting in donor-advised funds right now.

A donor-advised fund (DAF) is like a personal charity account managed by wealthy donors. These funds must eventually be given to a nonprofit, but it’s up to the donor to decide when and where.

How to Tap Into It:

- Build relationships with financial advisors and wealth managers who control access to DAFs.

- Create a “How to Support Us With Your DAF” page on your website with clear instructions.

- Promote DAF gifts as part of your year-end campaign messaging.

Quick Win: Add a “DAF Giving” option to your donation page, alongside credit card, PayPal, and ACH options.

How to Get Started (Without Overwhelming Your Team)

At this point, you’re probably thinking, “Do I really have to launch 7 new funding streams at once?” Absolutely not. The goal is to start with 1-2 that feel achievable.

Here’s your step-by-step game plan:

- Choose 2 funding streams that feel most attainable.

- Break them into small, specific actions (like sending 3 partnership emails or launching a peer-to-peer campaign).

- Track your progress (and celebrate every win, no matter how small).

Final Thoughts: Funding Diversification Is the Way Forward For Nonprofits

There’s no such thing as “too many revenue streams.” Diversifying your funding isn’t just about survival—it’s about growth, freedom, and control.

When you rely on one funding source (like grants), you’re vulnerable to sudden cuts. But when you diversify, you’re building a sustainable nonprofit that’s ready for anything.

So, where will you start?

- Will you pitch a corporate partner?

- Launch a monthly giving campaign?

- Call a potential major gift donor?

Whichever route you choose, just get started. The future of your nonprofit—and the people you serve—depends on it.